Best Book on Investing: The Intelligent Investor is here!

Moderators: alvin, learner, Dennis Ng

Best Book on Investing: The Intelligent Investor is here!

The Intelligent Investor is written by Benjamin Graham, the "sifu" (teacher) of Warren Buffett and Warren Buffett says "this is by far the best book on investing ever written"...

Now you can get it from our website at Special Discount. http://www.masteryourfinance.com/web/in ... &Itemid=35

Note: this is a physical book. We will mail the book to you in 2 weeks after payment. NO Mailing charges to you (only limited to address in Singapore).

_

I have read over 500 books, some are medicore, many are average, only very few books are outstanding, so outstanding that whenever I re-read the book once in a few years, that I always learn something new and get a deeper understanding of what is shared in the book.

_

If there is such a thing as the BEST book on Stock Investing, this is it. The Intelligent Investor written by Benjamin Graham, fondly known as the Father of Value Investing have influenced many investors, including the most Successful Investor in the World (living today), Warren Buffett, who considered Benjamin Graham his "sifu".

_

Below is Book Review I found on internet:

_

The first nine chapters cover investing basics that all investors could benefit from. There are many truisms spouted on Wall Street that are not really true. These chapters provide the investor with a realistic picture of how Wall Street works and what investors need to do to come out ahead.

_

Chapters 10-20 focus strictly on fundamental analysis, stock selection, convertible issues and warrants, and other subjects. Investors who plan to invest directly in stocks should make sure to read these chapters. However, for readers more interested in investing in mutual funds, and in particular index funds, they need not concern themselves with all the detail in these chapters unless they have the time or interest in the subject matter presented.

_

In conclusion, the combination of pioneer Ben Graham original work coupled with Jason Zweig meticulous and enjoyable update, make this a remarkable book about investments and investor behavior that every new and experienced investor should read.

Now you can get it from our website at Special Discount. http://www.masteryourfinance.com/web/in ... &Itemid=35

Note: this is a physical book. We will mail the book to you in 2 weeks after payment. NO Mailing charges to you (only limited to address in Singapore).

_

I have read over 500 books, some are medicore, many are average, only very few books are outstanding, so outstanding that whenever I re-read the book once in a few years, that I always learn something new and get a deeper understanding of what is shared in the book.

_

If there is such a thing as the BEST book on Stock Investing, this is it. The Intelligent Investor written by Benjamin Graham, fondly known as the Father of Value Investing have influenced many investors, including the most Successful Investor in the World (living today), Warren Buffett, who considered Benjamin Graham his "sifu".

_

Below is Book Review I found on internet:

_

The first nine chapters cover investing basics that all investors could benefit from. There are many truisms spouted on Wall Street that are not really true. These chapters provide the investor with a realistic picture of how Wall Street works and what investors need to do to come out ahead.

_

Chapters 10-20 focus strictly on fundamental analysis, stock selection, convertible issues and warrants, and other subjects. Investors who plan to invest directly in stocks should make sure to read these chapters. However, for readers more interested in investing in mutual funds, and in particular index funds, they need not concern themselves with all the detail in these chapters unless they have the time or interest in the subject matter presented.

_

In conclusion, the combination of pioneer Ben Graham original work coupled with Jason Zweig meticulous and enjoyable update, make this a remarkable book about investments and investor behavior that every new and experienced investor should read.

Cheers!

Dennis Ng - When You Master Your Finances, You Master Your Destiny

Note: I'm just sharing my personal comments, not giving you investment advice nor stock investment tips.

Dennis Ng - When You Master Your Finances, You Master Your Destiny

Note: I'm just sharing my personal comments, not giving you investment advice nor stock investment tips.

-

candy_chia

- Investing Mentor

- Posts: 1731

- Joined: Sun Jul 17, 2011 11:36 am

Re: Best Book on Investing: The Intelligent Investor is here

NEARLY all the Bull Markets had a number of well-defined characteristics in common, such as

(1) a Historically High Price Level

(2) High Price/Earning Ratios

(3) Low Dividend Yields as against Bond Yield

(4) Much Speculation on Margin

(5) Many Offerings of New Common-Stock Issues of POOR Quality

There were sufficient variations in the successive market cycles to complicate & sometimes frustrate the desirable process of Buying Low & Selling High.

The most notable of these departure, of course, was the Great Bull Market of late 1920s, which threw all calculations badly out of gear.

1897 to 1949 with 10 Complete market cycles running from bear-market low to bull-market high and back to bear-market low.

~~ 6 cycles lasted 4 Years;

~~~ 4 cycles lasted 6 to 7 years)

1921 to 1932 ===> LASTED 11 YEARS

(1) a Historically High Price Level

(2) High Price/Earning Ratios

(3) Low Dividend Yields as against Bond Yield

(4) Much Speculation on Margin

(5) Many Offerings of New Common-Stock Issues of POOR Quality

There were sufficient variations in the successive market cycles to complicate & sometimes frustrate the desirable process of Buying Low & Selling High.

The most notable of these departure, of course, was the Great Bull Market of late 1920s, which threw all calculations badly out of gear.

1897 to 1949 with 10 Complete market cycles running from bear-market low to bull-market high and back to bear-market low.

~~ 6 cycles lasted 4 Years;

~~~ 4 cycles lasted 6 to 7 years)

1921 to 1932 ===> LASTED 11 YEARS

-

candy_chia

- Investing Mentor

- Posts: 1731

- Joined: Sun Jul 17, 2011 11:36 am

Re: Best Book on Investing: The Intelligent Investor is here

In the financial markets,

the WORSE the Future looks,

the BETTER it Usually Turns out to be.

the WORSE the Future looks,

the BETTER it Usually Turns out to be.

-

candy_chia

- Investing Mentor

- Posts: 1731

- Joined: Sun Jul 17, 2011 11:36 am

Re: Best Book on Investing: The Intelligent Investor is here

Graham warned that you must treat Speculation as Veteran gamblers treat their trips to the Casino.

Just as sensible gamblers take, say $100 down to the casino floor and leave the rest of their money locked in the safe in their hotel room,

Intelligent Investor designates a tiny portion of her total portfolio as a "mad money" account.

For most of us, 10% of our overall wealth is the Maximum permissible amount to put at SPECULATIVE RISK.

~~ Never mingle the money in your SPECULATIVE Account with what's in your Investment Accounts

~~~ Never allow your speculative thinking to spill over into your investing activities; and

~~~~ Never put More than 10% of your assets into your mad money account, no matter what happens.

For better or worse, the Gambling Instinct is Part of Human Nature - so it's futile for most people even to try suppressing it.

But you must Confine and Restrain it.

That's the single best way to make sure you will never fool yourself into confusing speculation with investment.

http://www.masteryourfinance.com/forum/ ... TOR#p26325

Just as sensible gamblers take, say $100 down to the casino floor and leave the rest of their money locked in the safe in their hotel room,

Intelligent Investor designates a tiny portion of her total portfolio as a "mad money" account.

For most of us, 10% of our overall wealth is the Maximum permissible amount to put at SPECULATIVE RISK.

~~ Never mingle the money in your SPECULATIVE Account with what's in your Investment Accounts

~~~ Never allow your speculative thinking to spill over into your investing activities; and

~~~~ Never put More than 10% of your assets into your mad money account, no matter what happens.

For better or worse, the Gambling Instinct is Part of Human Nature - so it's futile for most people even to try suppressing it.

But you must Confine and Restrain it.

That's the single best way to make sure you will never fool yourself into confusing speculation with investment.

http://www.masteryourfinance.com/forum/ ... TOR#p26325

-

candy_chia

- Investing Mentor

- Posts: 1731

- Joined: Sun Jul 17, 2011 11:36 am

Re: Best Book on Investing: The Intelligent Investor is here

It's futile trying to predict or time the market.

Below are extracted from The Intelligent Investor:

Even Alan Greenspan, one of the nation's top financial forecasters urged investors to Buy stocks Without Hesitation on Jan 7, 1973 during an interview featured on New York Times: "It's very rare that you can be as unqualifiedly bullish as you can Now."

It's very rare that anyone can be ever been so unqualifiedly wrong as the future Federal Reserve chairman was that day: 1973 and 1974 turned out to be the Worst years for economic growth and the stock market since the Great Depression.

-

candy_chia

- Investing Mentor

- Posts: 1731

- Joined: Sun Jul 17, 2011 11:36 am

Re: Best Book on Investing: The Intelligent Investor is here

The True Investors

~ scarcely ever is forced to sell his shares, and

~~ at all time he is Free to Disregard the current price quotation.

==> He need Pay attention to it and Act Upon it only to the extent that it suits his book and no more*

Thus, the investor who permits himself to be

@ Stampeded or

@@ Unduly Worried or

@@@ Unjustified Market Declines in his Holdings

is perversely transforming his basic advantage (part owner of the various businesses he has invested, or as the holder of shares which are salable at any time he wishes at their quoted market price) into a basic disadvantage.

* "Only to the extent that it suits his book" means "only to the extent that the price is favorable enough to justify selling the stock."

In traditional brokerage lingo, the "book" is an investor's ledger of holdings and trades.

~ scarcely ever is forced to sell his shares, and

~~ at all time he is Free to Disregard the current price quotation.

==> He need Pay attention to it and Act Upon it only to the extent that it suits his book and no more*

Thus, the investor who permits himself to be

@ Stampeded or

@@ Unduly Worried or

@@@ Unjustified Market Declines in his Holdings

is perversely transforming his basic advantage (part owner of the various businesses he has invested, or as the holder of shares which are salable at any time he wishes at their quoted market price) into a basic disadvantage.

* "Only to the extent that it suits his book" means "only to the extent that the price is favorable enough to justify selling the stock."

In traditional brokerage lingo, the "book" is an investor's ledger of holdings and trades.

-

candy_chia

- Investing Mentor

- Posts: 1731

- Joined: Sun Jul 17, 2011 11:36 am

Re: Best Book on Investing: The Intelligent Investor is here

The most relistic Distinction between Investor and the Speculatior is found in

===> Their ATTITUDE toward Stock-market Movements.

Primary Interest of

==> Speculator - Anticipating and Profiting from Market Fluctuations

====> Investor - Acquiring and Holding Suitable Securities at SUITABLE PRICES.

Market Movements are important to Investor in a practical sense, because they alternately create

>>>>> LOW PRICE Lvels at which he would be WISE to BUY

>>>>>>>>> HIGH PRICE Levels at which he certainly Should REFRAIN from Buying and Probably would be WISE TO SELL.

===> Their ATTITUDE toward Stock-market Movements.

Primary Interest of

==> Speculator - Anticipating and Profiting from Market Fluctuations

====> Investor - Acquiring and Holding Suitable Securities at SUITABLE PRICES.

Market Movements are important to Investor in a practical sense, because they alternately create

>>>>> LOW PRICE Lvels at which he would be WISE to BUY

>>>>>>>>> HIGH PRICE Levels at which he certainly Should REFRAIN from Buying and Probably would be WISE TO SELL.

-

candy_chia

- Investing Mentor

- Posts: 1731

- Joined: Sun Jul 17, 2011 11:36 am

Re: Best Book on Investing: The Intelligent Investor is here

Investing INTELLIGENTLY is about Controlling the CONTROLLABLE.

=> You Can't Control whether the stocks or funds you buy will Outperform the market today, next week, this month, or this year; in the Short Run, your returns will Always be Hostage to Mr. Market and his whims.

=> But you CAN CONTROL:

1) your Brokerage costs - by Trading Rarely, PATIENTLY and CHEAPLY

2) your Ownership costs - by Refusing to buy mutual funds with Excessive Annual Expenses

3) Your Expectations - by using realism, not fantasy to Forecast your Returns

4) Your Risk - by deciding how much of your total asssets to put at hazard in the stock market, by DIVERSIFYING. and by Rebalancing

5) and Most of all, Your Own BEHAVIOR.

=> You Can't Control whether the stocks or funds you buy will Outperform the market today, next week, this month, or this year; in the Short Run, your returns will Always be Hostage to Mr. Market and his whims.

=> But you CAN CONTROL:

1) your Brokerage costs - by Trading Rarely, PATIENTLY and CHEAPLY

2) your Ownership costs - by Refusing to buy mutual funds with Excessive Annual Expenses

3) Your Expectations - by using realism, not fantasy to Forecast your Returns

4) Your Risk - by deciding how much of your total asssets to put at hazard in the stock market, by DIVERSIFYING. and by Rebalancing

5) and Most of all, Your Own BEHAVIOR.

-

candy_chia

- Investing Mentor

- Posts: 1731

- Joined: Sun Jul 17, 2011 11:36 am

Re: Best Book on Investing: The Intelligent Investor is here

Why do investors find Mr. Market so seductive?

It turns out that our brains are hardwired to get us into investing trouble; humans are pattern-seeking animals.

Psychologiest have shown that if you present people with random sequence - and tell them that it's unpredictable - they will nevertheless Insist on Trying to Guess What's Coming Next.

Groundbreaking research in neuroscience shows that our brains are designed to perceive trends even where they might not exist.

1) After an event occurs just 2 or 3 times in a row, regions of the human brain called the Anterior Cingulate and Nucleus accumbens automatically Anticipate that it will Happen Again.

If it does repeat,

a natural chemcial called Dopamine is released, flooding your brain with a soft Europhoria.

~~ Thus, if a stock goes Up a few times in a row, you reflexively expect it to keep going and your brain chemistry changes as the stock rises, giving you a "natural high." You effectively become addicted to your own predictions.

2) But when Stocks Drop, that financial Loss fires up your Amygdalathe part of the brain that processes Fear and Anxiety and generate "fight or flight" response that is common to all cornered animals.

~~ you Can't help Feeling Fearful when Stock Prices are Plunging.

~~~ psychologists Daniel Kahneman and Amos Tversky have shown that the Pain of Financial Loss is More than Twice as Intense as the Pleasure of an Equivalent Gain.

- Making $1,000 on a stock feels Great - But a $1,000 Loss wields an Emotional wallop more than twice as powerful

- Losing Money is so PAINFUL that many people Terrified at the prospect of any further loss, Sell out Near the Bottom or Refuse to Buy More.

- That helps explain why we fixate on the raw magnitude of a market decline and forget to put the loss in proportion.

- So, if a TV reporter hollers, "The market is plunging - the Dow is down 100 points!" most people instinctively shudder. (However, the drop is ony 1.2% based on the Dow's recent level of 8,000 mentioned in the book, most people forget to view changing market prices in percentage terms). It's all too easy to panic over minor vibrations.

It turns out that our brains are hardwired to get us into investing trouble; humans are pattern-seeking animals.

Psychologiest have shown that if you present people with random sequence - and tell them that it's unpredictable - they will nevertheless Insist on Trying to Guess What's Coming Next.

Groundbreaking research in neuroscience shows that our brains are designed to perceive trends even where they might not exist.

1) After an event occurs just 2 or 3 times in a row, regions of the human brain called the Anterior Cingulate and Nucleus accumbens automatically Anticipate that it will Happen Again.

If it does repeat,

a natural chemcial called Dopamine is released, flooding your brain with a soft Europhoria.

~~ Thus, if a stock goes Up a few times in a row, you reflexively expect it to keep going and your brain chemistry changes as the stock rises, giving you a "natural high." You effectively become addicted to your own predictions.

2) But when Stocks Drop, that financial Loss fires up your Amygdalathe part of the brain that processes Fear and Anxiety and generate "fight or flight" response that is common to all cornered animals.

~~ you Can't help Feeling Fearful when Stock Prices are Plunging.

~~~ psychologists Daniel Kahneman and Amos Tversky have shown that the Pain of Financial Loss is More than Twice as Intense as the Pleasure of an Equivalent Gain.

- Making $1,000 on a stock feels Great - But a $1,000 Loss wields an Emotional wallop more than twice as powerful

- Losing Money is so PAINFUL that many people Terrified at the prospect of any further loss, Sell out Near the Bottom or Refuse to Buy More.

- That helps explain why we fixate on the raw magnitude of a market decline and forget to put the loss in proportion.

- So, if a TV reporter hollers, "The market is plunging - the Dow is down 100 points!" most people instinctively shudder. (However, the drop is ony 1.2% based on the Dow's recent level of 8,000 mentioned in the book, most people forget to view changing market prices in percentage terms). It's all too easy to panic over minor vibrations.

Re: Best Book on Investing: The Intelligent Investor is here

I remember Hendra used to say we should not try to predict where the market is going next, but try to predict what most retail investor predict where the market is going next (this is a rephrase, pls correct if I am wrong), I think this make perfect sense in relation to what was posted, and we can make more sound decision on what to do next becos the market is made up of ppl!candy_chia wrote:Why do investors find Mr. Market so seductive?

It turns out that our brains are hardwired to get us into investing trouble; humans are pattern-seeking animals.

Psychologiest have shown that if you present people with random sequence - and tell them that it's unpredictable - they will nevertheless Insist on Trying to Guess What's Coming Next.

Groundbreaking research in neuroscience shows that our brains are designed to perceive trends even where they might not exist.

1) After an event occurs just 2 or 3 times in a row, regions of the human brain called the Anterior Cingulate and Nucleus accumbens automatically Anticipate that it will Happen Again.

If it does repeat,

a natural chemcial called Dopamine is released, flooding your brain with a soft Europhoria.

~~ Thus, if a stock goes Up a few times in a row, you reflexively expect it to keep going and your brain chemistry changes as the stock rises, giving you a "natural high." You effectively become addicted to your own predictions.

2) But when Stocks Drop, that financial Loss fires up your Amygdalathe part of the brain that processes Fear and Anxiety and generate "fight or flight" response that is common to all cornered animals.

~~ you Can't help Feeling Fearful when Stock Prices are Plunging.

~~~ psychologists Daniel Kahneman and Amos Tversky have shown that the Pain of Financial Loss is More than Twice as Intense as the Pleasure of an Equivalent Gain.

- Making $1,000 on a stock feels Great - But a $1,000 Loss wields an Emotional wallop more than twice as powerful

- Losing Money is so PAINFUL that many people Terrified at the prospect of any further loss, Sell out Near the Bottom or Refuse to Buy More.

- That helps explain why we fixate on the raw magnitude of a market decline and forget to put the loss in proportion.

- So, if a TV reporter hollers, "The market is plunging - the Dow is down 100 points!" most people instinctively shudder. (However, the drop is ony 1.2% based on the Dow's recent level of 8,000 mentioned in the book, most people forget to view changing market prices in percentage terms). It's all too easy to panic over minor vibrations.

Freelance Personal Trainer

http://johanngfitness.wordpress.com/

http://johanngfitness.wordpress.com/

Re: Best Book on Investing: The Intelligent Investor is here

and er Happy X-mas to all!

Freelance Personal Trainer

http://johanngfitness.wordpress.com/

http://johanngfitness.wordpress.com/

-

candy_chia

- Investing Mentor

- Posts: 1731

- Joined: Sun Jul 17, 2011 11:36 am

Re: Best Book on Investing: The Intelligent Investor is here

Without access to any real-time market data for consecutively 3 days (while spending my holidays overseas) had really spared me the anxiety & instead surprise me with further upside reward in my portfolio.

Think it is a marvellous idea to allocate my fund towards constructing a Permanent Portfolio as shared by Alvin , so as to spare me the "mental anguish" one day.

, so as to spare me the "mental anguish" one day.

Benjamin Graham stated thatThe Typical Investor "would be BETTER OFF if his Stocks had NO MARKET QUOTATION at All, for he would then be spared the mental anguish caused him by other persons' mistakes of judgement."

Similar to Warren Buffett quote, “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

If, after checking the value of your stock portfolio at 1:24 P.M., you feel compelled to check it all over again at 1:37 P.M., ask yourself these questions:

+ Did I call a real-estate agent to check the market price of my house at 1:24 P.M.? Did I call back at 1:37 P.M.?

++ If I had, would the price have changed? If it did, would I have rushed to sell my house?

+++ By not checking, or even knowing , the market price of my house from minute to minute, do I prevent the value from rising over time?

-> The only possible answer to these questions is Of Course Not! And you should view your portfolio the same way. Over a 10- or 20- or 30- year investment horizon, Mr. Market's daily dipsy-doodles simple Do Not Matter.

==> In any case, for anyone who will be Investing for Years to come, Falling Stock Prices are Good News, not bad, since they enable you to Buy More for Less Money. The longer and further stocks fall, and the more steadily you keep buying as they drop, the more money you will make in the end - if you remain steadfast until the end.

===> Instead of Fearing a Bear market, you Should Embrace it.

======> Intelligent Investor should be perfectly comfortable owning a stock or mutual fund even if the stock market Stopped supplying daily prices for the next 10 years.

====> By putting much of your portfolio on Permanent Autopilot,

~~ you can fight the prediction addiction,

~~~ focus on your long-term financial goals, and

~~~~ tune out Mr. Market's mood swings.

+++ In a series of remarkable experiments in the late 1990s, a psychologist at Columbia and Harvard, Paul Andreassen, showed that investors who received frequent news updates on their stocks earned HALF the returns of investors who got NO News at all.

Link on Permanent Portfolio:

http://www.masteryourfinance.com/forum/ ... lio#p26015

http://www.masteryourfinance.com/forum/ ... lio#p25167

http://www.masteryourfinance.com/forum/ ... lio#p24816

Think it is a marvellous idea to allocate my fund towards constructing a Permanent Portfolio as shared by Alvin

Benjamin Graham stated thatThe Typical Investor "would be BETTER OFF if his Stocks had NO MARKET QUOTATION at All, for he would then be spared the mental anguish caused him by other persons' mistakes of judgement."

Similar to Warren Buffett quote, “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

If, after checking the value of your stock portfolio at 1:24 P.M., you feel compelled to check it all over again at 1:37 P.M., ask yourself these questions:

+ Did I call a real-estate agent to check the market price of my house at 1:24 P.M.? Did I call back at 1:37 P.M.?

++ If I had, would the price have changed? If it did, would I have rushed to sell my house?

+++ By not checking, or even knowing , the market price of my house from minute to minute, do I prevent the value from rising over time?

-> The only possible answer to these questions is Of Course Not! And you should view your portfolio the same way. Over a 10- or 20- or 30- year investment horizon, Mr. Market's daily dipsy-doodles simple Do Not Matter.

==> In any case, for anyone who will be Investing for Years to come, Falling Stock Prices are Good News, not bad, since they enable you to Buy More for Less Money. The longer and further stocks fall, and the more steadily you keep buying as they drop, the more money you will make in the end - if you remain steadfast until the end.

===> Instead of Fearing a Bear market, you Should Embrace it.

======> Intelligent Investor should be perfectly comfortable owning a stock or mutual fund even if the stock market Stopped supplying daily prices for the next 10 years.

====> By putting much of your portfolio on Permanent Autopilot,

~~ you can fight the prediction addiction,

~~~ focus on your long-term financial goals, and

~~~~ tune out Mr. Market's mood swings.

+++ In a series of remarkable experiments in the late 1990s, a psychologist at Columbia and Harvard, Paul Andreassen, showed that investors who received frequent news updates on their stocks earned HALF the returns of investors who got NO News at all.

Link on Permanent Portfolio:

http://www.masteryourfinance.com/forum/ ... lio#p26015

http://www.masteryourfinance.com/forum/ ... lio#p25167

http://www.masteryourfinance.com/forum/ ... lio#p24816

-

candy_chia

- Investing Mentor

- Posts: 1731

- Joined: Sun Jul 17, 2011 11:36 am

Re: Best Book on Investing: The Intelligent Investor is here

The whole point of Investing is Not to earn More Money than Average,

====> but to Earn ENOUGH Money to Meet Your Own Needs.

The best way to measure your investing success is

~~ Not by Whether you're Beating the market

but by Whether you've put in place a

(1) FINANCIAL PLAN &

(2) BEHAVIORAL DISCIPLINE

that are likely to get you where you want to go.

In the end, what Matters isn't crossing the finish line before anybody else but Just Making sure that You DO CROSS IT.

====> but to Earn ENOUGH Money to Meet Your Own Needs.

The best way to measure your investing success is

~~ Not by Whether you're Beating the market

but by Whether you've put in place a

(1) FINANCIAL PLAN &

(2) BEHAVIORAL DISCIPLINE

that are likely to get you where you want to go.

In the end, what Matters isn't crossing the finish line before anybody else but Just Making sure that You DO CROSS IT.

-

candy_chia

- Investing Mentor

- Posts: 1731

- Joined: Sun Jul 17, 2011 11:36 am

Re: Best Book on Investing: The Intelligent Investor is here

The Total Stock-market Index Fund is similar to what Alvin suggested,

~~ STI ETF (expense ratio of 0.3%) or

~~~ Vanguard World Stock ETF (expense ratio of 0.22%)

http://www.bigfatpurse.com/2012/06/impl ... singapore/

https://personal.vanguard.com/us/funds/ ... IntExt=INT

Below are extracted from Intelligent Investor:

If your Investment Horizon is Long - at least 25 or 30 years - there is only 1 sensible approach:

=> Buy Every Month, Automatically, and whenever else you can spare some money.

==>The Single Best choice for lifelong holding is a Total Stock-market Index Fund.

---> Sell only when you Need the Cash

~~ STI ETF (expense ratio of 0.3%) or

~~~ Vanguard World Stock ETF (expense ratio of 0.22%)

http://www.bigfatpurse.com/2012/06/impl ... singapore/

https://personal.vanguard.com/us/funds/ ... IntExt=INT

Below are extracted from Intelligent Investor:

If your Investment Horizon is Long - at least 25 or 30 years - there is only 1 sensible approach:

=> Buy Every Month, Automatically, and whenever else you can spare some money.

==>The Single Best choice for lifelong holding is a Total Stock-market Index Fund.

---> Sell only when you Need the Cash

Re: Best Book on Investing: The Intelligent Investor is here

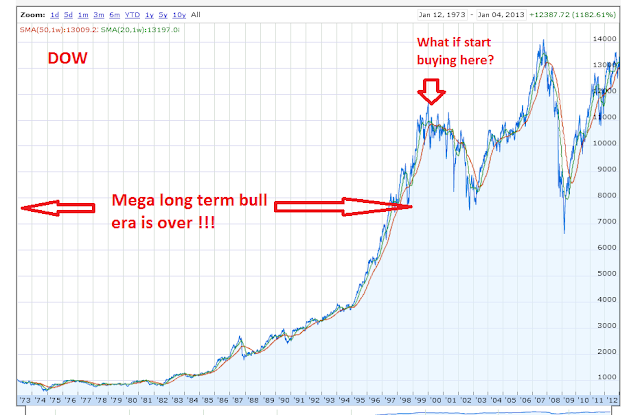

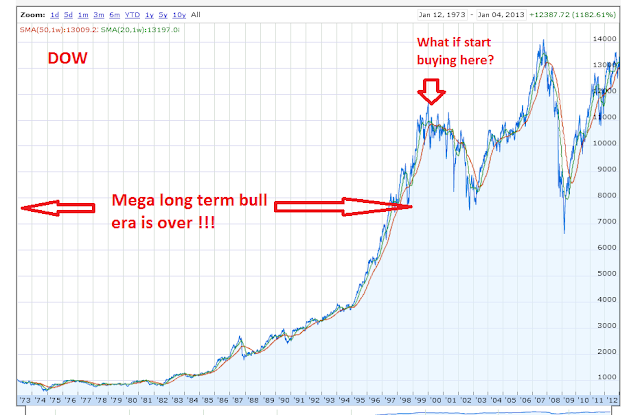

I think Graham's long-term 20-30 year investment strategy of investing does not work for last 2 decades.

Its strategy worked after the 2nd world war till 1999; before the 2000 dot.com and 911 crisis.

What is the return if one start buying from 2000 and continue to invest monthly/quarterly/yearly till 2012? With such short market cycles and the bear correction of -60%, does he/she have the mental power to stay the rough course? Continue buying when the market keeps going down?

Think about it...

To me, buy and hold is dead!

Learn to invest Market Cycle Strategy as taught by late Dennis.

Its strategy worked after the 2nd world war till 1999; before the 2000 dot.com and 911 crisis.

What is the return if one start buying from 2000 and continue to invest monthly/quarterly/yearly till 2012? With such short market cycles and the bear correction of -60%, does he/she have the mental power to stay the rough course? Continue buying when the market keeps going down?

Think about it...

To me, buy and hold is dead!

Learn to invest Market Cycle Strategy as taught by late Dennis.

candy_chia wrote:The Total Stock-market Index Fund is similar to what Alvin suggested,

~~ STI ETF (expense ratio of 0.3%) or

~~~ Vanguard World Stock ETF (expense ratio of 0.22%)

http://www.bigfatpurse.com/2012/06/impl ... singapore/

https://personal.vanguard.com/us/funds/ ... IntExt=INT

Below are extracted from Intelligent Investor:

If your Investment Horizon is Long - at least 25 or 30 years - there is only 1 sensible approach:

=> Buy Every Month, Automatically, and whenever else you can spare some money.

==>The Single Best choice for lifelong holding is a Total Stock-market Index Fund.

---> Sell only when you Need the Cash

Price is what you pay; Value is what you get

RayNg

RayNg