Hi All,

I hope this story, and my sharing below, will serve us as reminder on how the stock market "works". In fact, I think, it also "works" in any investment vehicles.

yhendra wrote:I'd like to re-post this story, and hopefully during the last rally before crisis come everybody in this forum knows what to do...

From the story, you should have a better understanding of how the stock market works - the scheme, the higher prices, the greed, the no stock, the "timely announcement", etc. Think of the monkey as the stock, and you will get the meaning of this story!!!

Think the process happening in this story as demand & supply or accumulation & distribution.

Here is the story, extracted from someone named "Imran":-

Once upon a time in a village in India, a man appeared and announced to the villagers that he would buy monkeys at $10 each.

The villagers, seeing that there were many monkeys around, went into the forest and started catching them. The man very gentlemanly bought thousands of monkeys at $10 each,but as supply started to diminish, the villagers slowed down and eventually stopped their efforts.

The man then announced that he would now buy at $20. This renewed the energy and efforts of the villagers and they started catching monkeys again. Soon the supply diminished even further, and people started going back to their farms.

The offer was then increased to $25 each, but the supply of monkeys became so little that it was a almost a miracle to even spot a monkey, let alone catch one.

The man now announced that he would buy monkeys at $50 ! However, since he had to go to the city on some business, his assistant would transact on his behalf.

In the absence of the man, the assistant assembled the villagers and told them : " Look at all these monkeys in the big cages that the man has collected. I will sell them to you at $35 each, and when the man returns from the city, you can in turn sell them to him at $50 each. Deal or no deal ? "

The excited villagers, smelling a quick-profit killer opportunity, immediately rounded up all their savings and bought all the monkeys. Then they never saw the man nor his assistant again, and there were just monkeys everywhere!

-End-

Additionally, in summary investment is ALL about

ACCUMULATION and

DISTRIBUTION or

Buy LOW and

sell HIGH.

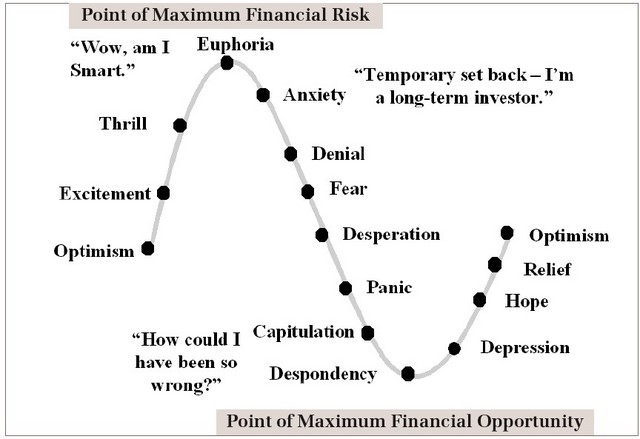

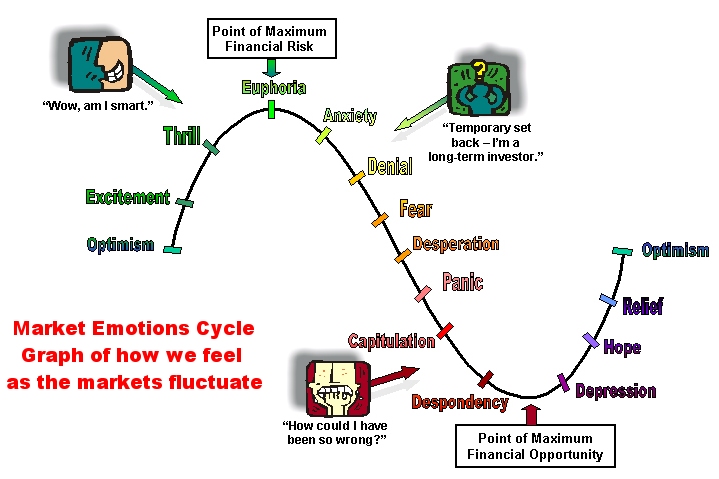

Some of you may heard OR may have not heard at all that the market (be it stock market or property market) UP or DOWN is driven by the GREED and FEAR.

GREED = to make quick profit thinking with this we can be rich in the bull market... where we actually buy from people who distribute their stocks along the way at the top of the market....

FEAR = fear of loosing money, once we are caught in this situation we fail to take action until we are depressed and actually we sell our stock to people who accumulate it...!!

So...

Accumulation = Buy Low

This is where majority of average investors at their MOST FEARFUL moment... panic, capitulated, desponded, depressed.

Distribution = Sell High

This is where majority of average investors are mostly GREEDY to make quick profit, to be rich quickly, they are excited, thrilled...

See these two pictures, which I hope can be used as a reflection and reference:

The formula that has been given, (I add my own TA

), for the investment strategy:

(FA + TA + CSA) + TA = (Fundemental Analysis + Technical Analysis + Common Sense Analysis) + Taking Action.

WHAT to Buy? Use FA + CSA

WHEN to Buy? Use TA + CSA

WHEN to Sell? Use TA + CSA

All of these must be back-up by taking action!!!

On another important lesson learn I have; some of you may know

"80/20 rules". Read it

here if you do not know.

If we apply this rule in the stock market, it may go like this:

Only 20% of the participants (savvy investors, expert, big institutions) make the money in the stock market, where 80% of the money is supplied by average investors (like us).

Now,

I don't want to be in the 80% position anymore. I want to move to the 20% position.

And I really hope all of you will not be disheartened by the recent stock market crash....

Try to build back your confident level, and together with the sharing in this forum we can all be prepared and benefit from the up-coming crisis... we all can all move to be in the 20% position.

In 2003, I made BIG lost... in 2007... I made another BIG lost... In total, which I would not be shy to declare here: I made lost in total about $50K.

Maybe for some of you this amount is big, but for others maybe small.... It doesn't matter.

It's all relative....

Anyway, this time round with all of the above knowledge PLUS knowledge shared by Dennis...

in total

I made just a little bit... because like most of you... I was also caught of guard from the sudden stock market crash.... almost all the profit wipe out after I realized the losses, by selling about 90% of the stock I own, left only one stock that hopefully still giving me dividend along the way although smaller...

As you all may have this wish, I also wish I attended Dennis seminar much earlier to learn all the knowledge earlier in 2009, so I could ride on the up-trend. But... arrghh... I just managed to attend his stock & property seminars in late 2010 (Sep/Oct).

Just a side notes that actually I have learned a lot more from him in terms of personal development... among other things: CBA (Conceive, Believe, Achieve), the law of attraction, the book "The Master Plan to Success" by Napoleon Hill, "What is Money? What is Wealth?"

Another note, do I blame him if the last train, that he has been sharing, never come?

Nope. Like dragonhart2 mentioned in his posting (read it

here) Dennis is NOT God. He just 'predict' based on the best knowledge he has, the best method that works, that has made him millionaire.

We all have brain to think and process information... we all have the power to choose to take action or not to take action....

If you drive a car, you know that you need to go to school to learn to drive.

The trainer will teach you all the road signs, regulations, driving on the circuit training, on the road with the trainer...

BUT, at the end of the day... you need to have more experience on the road BY YOURSELF... NOT with the trainer.... You must be able to handle all your emotion during driving on the highway... taken over by another driver, facing a traffic jam, facing an errant driver, etc.

Likewise, Dennis has trained us with the required knowledge how to be a millionaire by investment in stock market and property.

At the end of the day we all need experience on the road... handle our emotion during the rough time, facing losses... etc.

When you hit an accident while you are driving, you can swear and curse that you will not be driving anymore... Or you learn the lesson and still have the courage to drive again....

Likewise, in investment you hit an accident, making losses. You can swear and curse that you will not touch the stock market ever again... Or you learn the lesson and still have the courage to make another investment.

BTW, I am now 42+ already, same age like Dennis.

But I AM OPTIMISTIC that I can be a millionaire within another 5 to 10 years time...

First mistake in 2003, second mistake in 2007. I will not repeat the third time the mistakes....

For myself, personally, I value the process that I have been going through, rather than the result. Because, I know that the result will come when I have the right mindset, positive thinking, knowledge, like-minded people around me...

Like Dennis suggest, this forum can be used to pour out our experience and sharing right now... and when we look back, we all can see what had happened...

I hope I have summarized the above concepts and my sharing in the most comprehensive manners. I also hope this posting useful for all of you.